Jewelry Investment Pieces: Which Gemstones Hold Value Over Time?

Learn which gemstones are the best investments for long-term value. Explore diamonds, sapphires, rubies, emeralds, and pearls that retain worth over time, plus essential factors like origin, treatment, and craftsmanship.

3 Minute Read

Fine jewelry is often seen as more than personal adornment—it's a reflection of taste, heritage, and in many cases, a long-term investment. While trends shift and preferences evolve, certain gemstones continue to hold or even appreciate in value over time. Whether you're building a collection or looking to pass something down, understanding which stones tend to retain their worth is essential.

What Makes a Gemstone a Good Investment?

Not all gemstones are created equal—especially when it comes to long-term value. Investment potential is shaped by factors like rarity, clarity, craftsmanship, and origin. Gemstones with strong provenance, such as Burmese rubies, Colombian emeralds, and untreated Kashmir sapphires, have historically performed well due to their scarcity and collector demand.

Understanding how are pearls made can offer insight into why certain types—like South Sea or Tahitian pearls—command higher prices. While pearls differ from crystalline gems, high-quality examples with exceptional luster and surface clarity have shown consistent value retention, especially in classic formats.

For example, knowing how much are pearls worth can help collectors compare options across quality tiers. And for those looking to add something rare yet wearable, a black pearl necklace offers timeless appeal with investment potential.

Top Gemstones Known for Holding Value

If you're looking to invest in gemstones, certain stones have historically shown resilience and demand:

1. Diamonds

A classic for a reason. White diamonds, especially those with high clarity, color, and carat, maintain strong resale value. Fancy colored diamonds—such as pink or yellow—can appreciate even faster due to their rarity.

2. Sapphires

Particularly those from Sri Lanka (Ceylon) or Kashmir, blue sapphires remain highly sought after. Their durability (a 9 on the Mohs scale) also makes them suitable for everyday wear.

3. Rubies

Vivid red rubies from Myanmar (Burma) are among the most valuable gemstones in the world. They are rarer than diamonds and often command exceptionally high prices when untreated and of excellent quality.

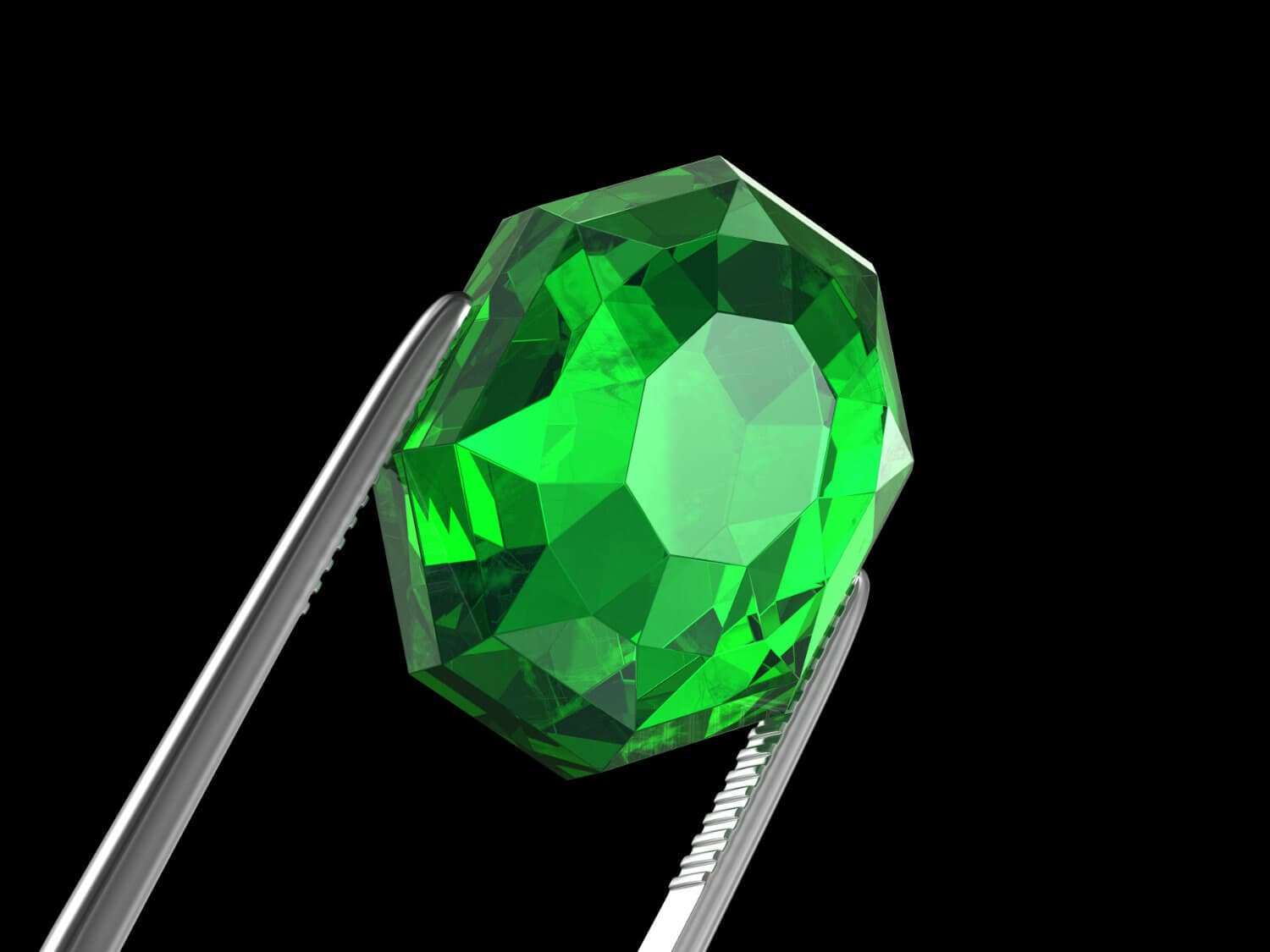

4. Emeralds

While emeralds often have visible inclusions, high-quality Colombian emeralds continue to fetch strong prices. Their deep green color is instantly recognizable and prized among collectors.

5. Pearls

Natural pearls are rare and incredibly valuable—but cultured pearls, when high in quality, offer both accessibility and enduring appeal. South Sea and Tahitian pearls in particular tend to maintain strong market value, especially in necklace and bracelet form.

Factors That Impact Long-Term Value

Even within these popular gemstones, several details can dramatically influence investment potential:

- Origin and certification: Stones with verified provenance (like Kashmir sapphires or Colombian emeralds) are more desirable.

- Treatment: Untreated gemstones often hold more value. Heat-treated stones are common and sometimes necessary, but they should always be disclosed.

- Rarity of color: Unusual shades, such as Padparadscha sapphires or pigeon's blood rubies, tend to drive up demand.

- Craftsmanship: Jewelry from renowned houses (e.g., Cartier, Van Cleef & Arpels) often retains higher value due to brand legacy and superior workmanship.

For a breakdown of estimated per-carat prices across a wide range of stones, a Gemstone Price Guide is a great place to start your research.

Protecting Your Investment

Like any long-term asset, jewelry requires upkeep. If you're considering investing in gemstones, here's how to protect yourself:

- Insure your collection: Gemstone appraisals from certified gemologists can help you insure your pieces at full replacement value.

- Store them properly: Keep gemstones in soft-lined cases, away from direct sunlight, humidity, or extreme temperature changes.

- Wear with care: While it's tempting to show off your finest pieces often, avoid wearing them during strenuous activity or in harsh environments.

Professional cleanings and regular inspections also help maintain condition—and by extension, value.

Final Thoughts

Building a jewelry collection with long-term value means going beyond trends. Focus on quality over quantity, learn the stories behind each stone, and don't be afraid to invest in craftsmanship that lasts. Whether it's a vivid sapphire, a flawless diamond, or a luminous strand of pearls, your next jewelry purchase could become a cherished asset for years to come.